Malaysia Trade Performance

November 2020 and the Period of Jan-Nov 2020

Exports Continued to Expand for Three Consecutive Months

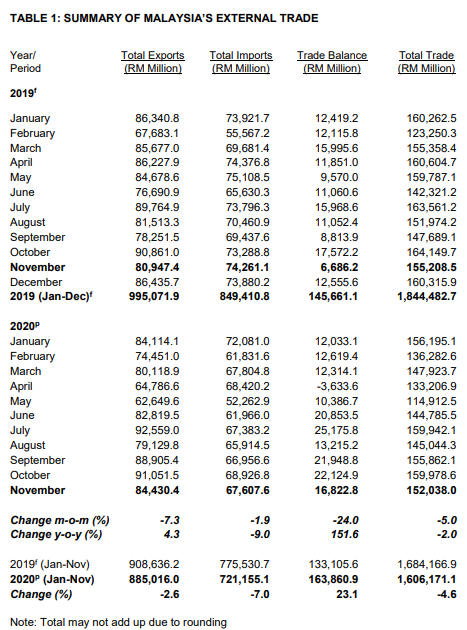

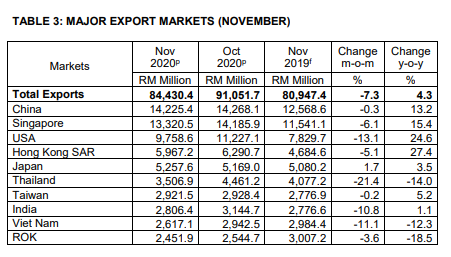

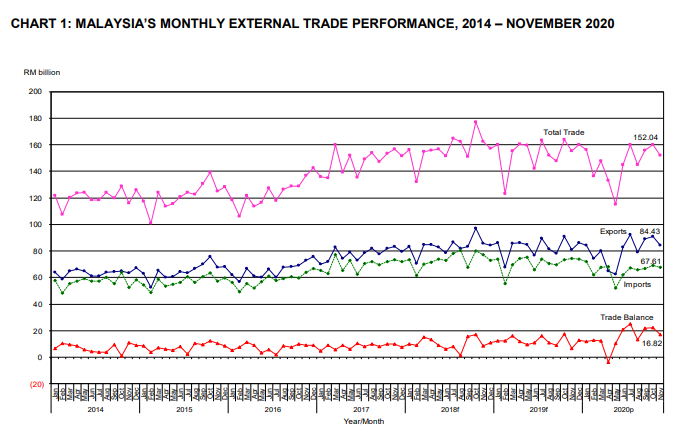

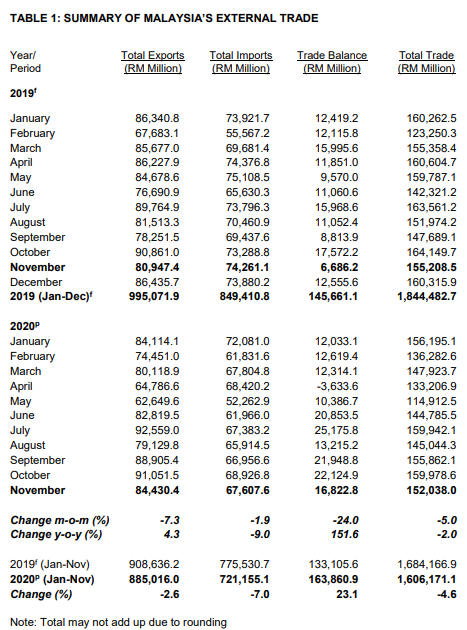

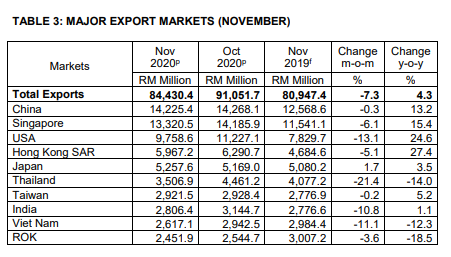

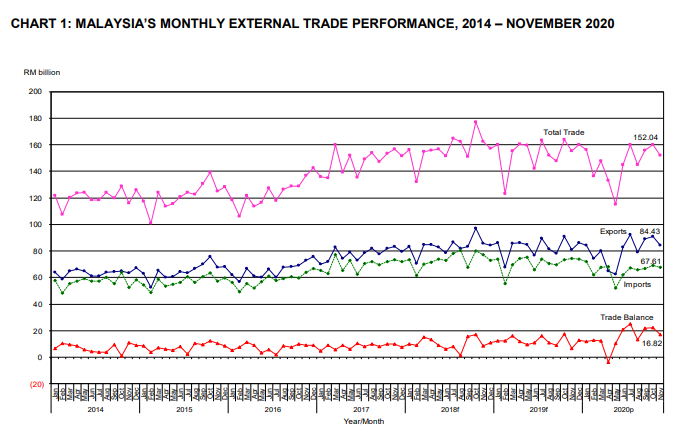

Malaysia’s exports in November 2020 increased by 4.3% to RM84.43 billion compared to the same month last year, registering three consecutive months of year-on-year (y-o-y) growth. The expansion was supported mainly by higher exports to the United States (US), Singapore, China and Hong Kong SAR.

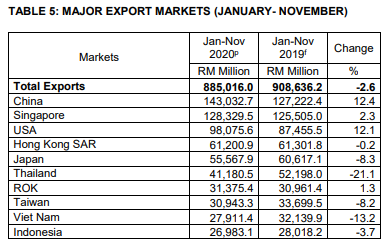

Imports in November 2020 was RM67.61 billion, decreased by 9% y-o-y while total trade reached RM152.04 billion, contracted by 2%. Trade surplus amounted to RM16.82 billion, surged by 151.6% and was the highest trade surplus thus far for the month of November. Compared to October 2020, total trade, exports, imports and trade surplus decreased by 5%, 7.3%, 1.9% and 24%, respectively. For the first 11 months of 2020, trade surplus recorded double-digit growth of 23.1% to RM163.86 billion compared to the same period of 2019. Total trade was valued at RM1.606 trillion, a decline of 4.6%. Exports stood at RM885.02 billion, contracting by 2.6% while imports were RM721.16 billion, decreased by 7%.

Export Performance of Major Sectors

Manufactured and Agriculture Goods Contributed to Export Growth

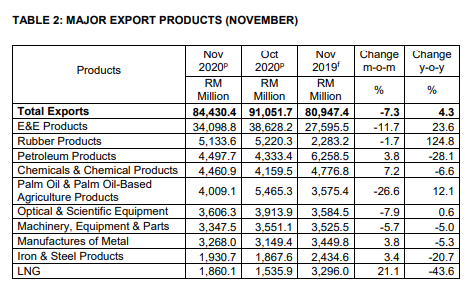

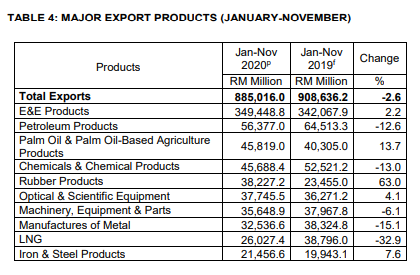

In November 2020, exports of manufactured goods which contributed to 88.1% of total exports rose by 8.1% y-o-y to RM74.34 billion. The growth was buoyed mainly by higher exports of electrical and electronic (E&E) products as well as rubber products. Exports of rubber products recorded resilient performance with 13 consecutive months of growth. Higher exports were also registered for other manufactures especially solid-state storage devices (SSD), wood products as well as optical, scientific and equipment.

Exports of agriculture goods (6.7% share) increased by 6% to RM5.65 billion compared to a year ago driven mainly by higher exports of palm oil and palm oil-based agriculture products.

Exports of mining goods (4.9% share) contracted by 34.6% y-o-y to RM4.15 billion following lower exports of liquefied natural gas (LNG), crude petroleum as well as petroleum condensates and other petroleum oil.

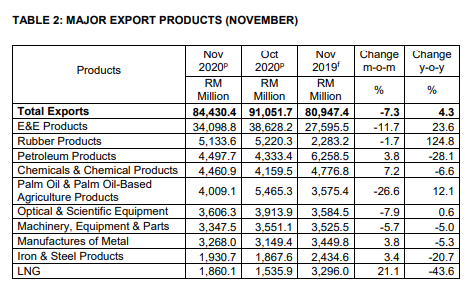

Major Exports in November 2020:

- E&E products, valued at RM34.1 billion and constituted 40.4% of total exports, increased by 23.6% from November 2019;

- Rubber products, RM5.13 billion, 6.1% of total exports, surged by 124.8%;

- Petroleum products, RM4.5 billion, 5.3% of total exports, decreased by 28.1%;

- Chemicals and chemical products, RM4.46 billion, 5.3% of total exports, declined by 6.6%; and

- Palm oil and palm oil-based agriculture products, RM4.01 billion, 4.7% of total exports, increased by 12.1%.

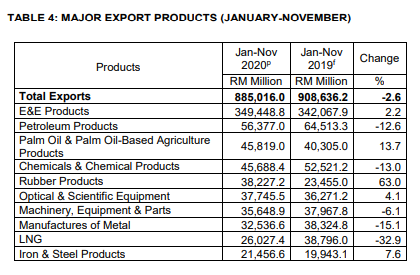

On a month-on-month (m-o-m) basis, exports of mining goods increased by 15.8%, while manufactured and agriculture goods contracted by 7% and 21.2%, respectively. During the first 11 months of 2020, exports of manufactured goods slipped marginally by 0.3% to RM765.63 billion compared to the same period of 2019, on account of lower exports of petroleum products, chemicals and chemical products as well as manufactures of metal. Meanwhile, higher exports were recorded for rubber products, E&E products, other manufactures (SSD), iron and steel products as well as optical and scientific equipment. Exports of agriculture goods grew by 5% to RM63.32 billion attributed mainly to higher exports of palm oil and palm oil-based agriculture products. Exports of mining goods fell by 29.7% to RM52.21 billion due to lower exports of LNG, crude petroleum as well as petroleum condensates and other petroleum oil.

Trade Performance with Major Markets

Exports of E&E Products Remained Resilient to ASEAN

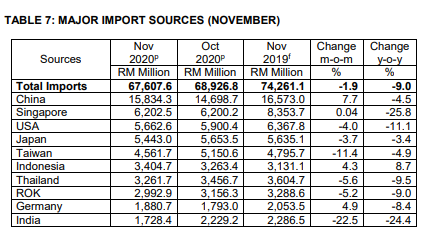

Trade with ASEAN in November 2020 which constituted RM38.77 billion or 25.5% of Malaysia’s total trade, fell by 7.2% compared to November 2019. Exports edged down by 2.2% to RM23.46 billion owing to lower exports of petroleum products, iron and steel products as well as machinery, equipment and parts. Exports of E&E products which increased by 36.6% or RM2.6 billion however cushioned the decline. Imports from ASEAN dropped by 13.9% to RM15.31 billion.

Breakdown of exports to ASEAN countries:

- Singapore RM13.32 billion, increased by 15.4%

- Thailand RM3.51 billion, down 14.0%

- Viet Nam RM2.62 billion, down 12.3%

- Indonesia RM2.07 billion, down 33.7%

- Philippines RM1.35 billion, down 12.4%

- Myanmar RM246.9 million, down 33.8%

- Brunei RM231.9 million, up 20.2%

- Cambodia RM109.7 million, down 21.9%

- Lao PDR RM3.0 million, down 14.8%

Exports to markets in ASEAN that recorded expansion were Singapore which increased by RM1.78 billion attributed to stronger exports of E&E products while exports to Brunei rose by RM39 million on account of higher exports of iron and steel products.

On an m-o-m basis, trade, exports and imports were down by 5.8%, 8.8% and 0.7%, respectively.

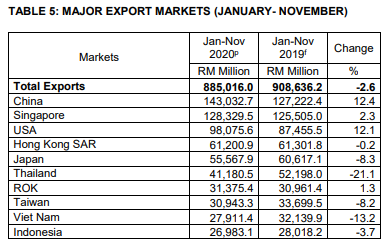

In January to November 2020, trade with ASEAN was valued at RM404.62 billion, contracted by 10.2% compared to the same period in 2019. Exports to this region amounted to RM247.18 billion, slipped by 5.7% due to lower exports of crude petroleum, manufactures of metal as well as chemicals and chemical products. However, increases in exports were recorded for E&E products, transport equipment and other manufactures (SSD). Imports from ASEAN decreased by 16.5% to RM157.44 billion.

E&E Products Drove Export Growth to China

Trade with China in November 2020 rose by 3.2% y-o-y to RM30.06 billion, accounting for 19.8% of Malaysia’s total trade. Exports to China recorded a double-digit expansion of 13.2% to RM14.23 billion mainly on higher exports of E&E products.

Imports from China were down by 4.5% to RM15.83 billion. Compared to October 2020, trade and imports increased by 3.8% and 7.7%, respectively while exports decreased by 0.3%. Trade with China during the period of January to November 2020 rose by 3.2% to RM296.18 billion compared to the same period in 2019. Exports registered double-digit growth of 12.4% to RM143.03 billion, driven by higher exports of iron and steel products, other manufactures (SSD), manufactures of metal, E&E products as well as palm oil and palm oil-based agriculture products. Imports from China amounted to RM153.14 billion, lower by 4.1%.

Exports to the US Continued with Double-Digit Growth

In November 2020, trade with the US contributed 10.1% to Malaysia’s total trade, registering a growth of 8.6% y-o-y to RM15.42 billion. Exports to the US recorded double-digit growth for six consecutive months, surged by 24.6% to RM9.76 billion in November 2020. Higher exports were recorded for rubber products, E&E products, and wood products. Imports from the US contracted by 11.1% to RM5.66 billion.

Compared to October 2020, trade, exports and imports declined by 10%, 13.1% and 4%, respectively.

In the first 11 months of 2020, trade with the US was up by 7.6% to RM161.8 billion compared to the same period of 2019. Exports registered a double-digit growth of 12.1% to RM98.08 billion buoyed by higher exports of rubber products, wood products, E&E products, other manufactures (SSD) as well as machinery, equipment and parts. Imports from the US rose by 1.3% to RM63.73 billion.

Exports Continued to Expand for Three Consecutive Months to the EU

Total trade with the European Union (EU) which accounted for 7.7% of Malaysia’s total trade in November 2020, shrank by 4.9% y-o-y to RM11.64 billion. Exports continued to expand for three consecutive months, expanding by 7.1% to RM6.89 billion contributed mainly by higher exports of rubber products. Imports from the EU shrank by 18.2% to RM4.75 billion.

Among the top 10 EU markets which accounted for 90.4% of Malaysia’s total exports to the EU, exports to eight countries recorded increases namely, Germany (up 3.6%), the Netherlands (up 2.9%), Italy (up 46.7%), Belgium (up 12.2%), Spain (up 6%), Poland (up 56.3%), the Czech Republic (up 25.3%) and Sweden (up 60%).

Compared to October 2020, trade, exports and imports slipped by 10.4%, 11.4% and 9.1%, respectively.

For the first 11 months of 2020, trade with the EU was valued at RM129.79 billion, decreased by 11.3% compared to the same period of 2019. Exports which totalled RM76.23 billion edged down by 5.8% following lower exports of E&E products. Higher exports however were recorded for rubber products as well as palm oil and palm oil-based agriculture products. Imports from the EU amounted to RM53.56 billion, fell by 18.1%.

Exports to Japan Rebounded

In November 2020, trade with Japan which made up 7% of Malaysia’s total trade recorded a marginal decline of 0.1% y-o-y to RM10.7 billion. Exports picked up by 3.5% to RM5.26 billion after registering four consecutive months of y-o-y contraction.

The growth was contributed mainly by higher exports of rubber products, E&E products, crude petroleum, palm oil and palm oil-based agriculture products as well as optical and scientific equipment. Imports from Japan dropped by 3.4% to RM5.44 billion.

On a m-o-m basis, exports grew by 1.7%, while trade and imports contracted by 1.1% and 3.7%, respectively.

For the period of January to November 2020, trade with Japan was down by 6.4% to RM110.43 billion compared to the same period of 2019. Exports declined by 8.3% to RM55.57 billion due mainly to lower exports of LNG. However, increases in exports were registered for crude petroleum, rubber products, optical and scientific equipment as well as palm oil and palm oil-based agriculture products. Imports from Japan was lower by 4.4% to RM54.86 billion.

Trade with FTA Partners

In November 2020, trade with Free Trade Agreement (FTA) partners which made up 67.6% of Malaysia’s total trade was valued at RM102.77 billion, a decline of 2.4% y-o-y. Exports to FTA partners amounted to RM58.04 billion, increased by 3.6% while imports contracted by 9.2% to RM44.73 billion.

Higher exports were recorded to Turkey, by 26.2% to RM710.7 million due to higher exports of manufactures of metal, Pakistan (up 17.9% to RM407.4 million, petroleum products), New Zealand (up 12.4% to RM402.8 million, crude petroleum), Chile (up 82.2% to RM89.2 million, chemicals and chemical products) and India (up 1.1% to RM2.81 billion, palm oil and palm oil-based agriculture products).

Compared to October 2020, imports rose by 0.7%, while trade and exports declined by 2.2% and 4.4%, respectively. Trade with FTA partners for the first 11 months of 2020 which accounted for 66.5% of Malaysia’s total trade reduced by 4.9% to RM1.068 trillion. Exports amounted to RM602 billion, a decline of 2.8% while imports totalled RM466.47 billion, lower by 7.5%.

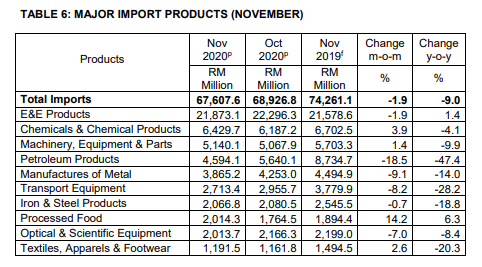

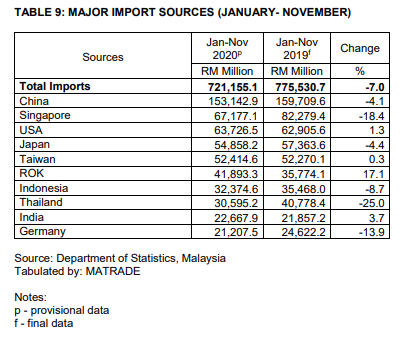

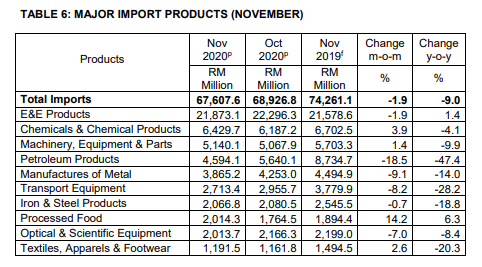

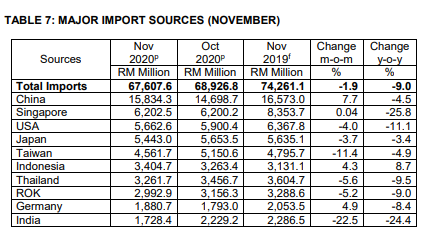

Import Performance

Total imports in November 2020 contracted by 9% y-o-y to RM67.61 billion from RM74.26 billion in November 2019. The three main categories of imports by end-use which accounted for 74.1% of total imports were:

- Intermediate goods, valued at RM36.64 billion or 54.2% share of total imports, decreased by 10.6%, following lower imports of parts and accessories of capital goods (except transport equipment), particularly electrical machinery, equipment and parts;

- Capital goods, valued at RM7.19 billion or 10.6% of total imports, declined by 26.5%, due mainly to reduced imports of capital goods (except transport equipment), primarily electrical machinery, equipment and parts; and

- Consumption goods, valued at RM6.27 billion or 9.3% of total imports, contracted by 7.2%, as a result of lower imports of non-durables, especially pharmaceutical products.

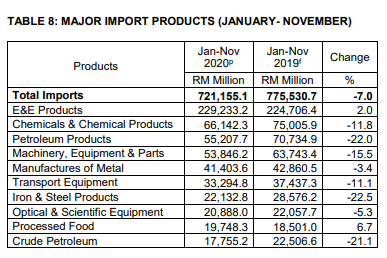

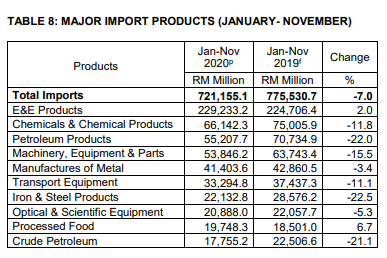

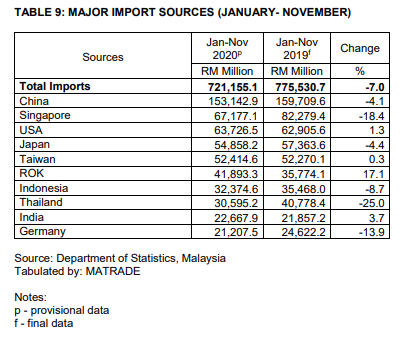

During January to November 2020, imports amounted to RM721.16 billion, decreased by 7% from the same period of 2019. Imports of intermediate goods totalled RM383.06 billion, decreased by 9.9%, capital goods (RM81.96 billion, down 10.5%) and consumption goods (RM66.86 billion, down 0.7%).

Note:

It should be noted that, conceptually, the export and import figures in the external trade statistics are different from that in the goods account of the balance of payments compilation. The compilation of international merchandise trade statistics is usually based on customs records, which essentially reflect the physical movement of goods across borders, and follow international guidelines on concepts and definitions i.e. International Merchandise Trade Statistics: Concepts and Definitions 2010 (IMTS 2010) which is different from the principles of the System of National Accounts (SNA) and the Balance of Payments Compilation. Goods are defined in the SNA as “physical objects for which a demand exists, over which ownership rights can be established and whose ownership can be transferred from one institutional unit to another by engaging in transactions on markets”.

“This is a preliminary release, full details would be published in the “MONTHLY EXTERNAL TRADE STATISTICS” report by the Department of Statistics, Malaysia, to be disseminated on Friday, 4th December 2020 and can be downloaded through statistic at the Department of Statistics, Malaysia’s portal (https://www.dosm.gov.my/v1).

+ This media release can be accessed through the portal of Malaysian External Trade Statistics, Ministry of International Trade and Industry (http://www.miti.gov.my) and Malaysia External Trade Development Corporation (http://www.matrade.gov.my).

# The November 2020 data is provisional and subject to revision in a later issue.

With effect from reference month April 2018, selection of codes for exports and imports of palm oil and palm oil-based products have been reviewed and revised for better representation of the product and this has

resulted in some changes to the data.

FTA partners comprise of 19 countries: China, Singapore, Japan, Thailand, Republic of Korea, Indonesia, India, Australia, Viet Nam, Philippines, New Zealand, Turkey, Pakistan, Myanmar, Cambodia, Brunei, Chile, Lao PDR and Hong Kong SAR.

With effect from reference month of February 2020, the United Kingdom no longer be a Member State of the European Union (EU).