Note:

It should be noted that, conceptually, the export and import figures in the external trade statistics are different

from that in the goods account of the balance of payments compilation. The compilation of international

merchandise trade statistics is usually based on customs records, which essentially reflect the physical

movement of goods across borders, and follow international guidelines on concepts and definitions i.e.

International Merchandise Trade Statistics: Concepts and Definitions 2010 (IMTS 2010) which is different from

the principles of the System of National Accounts (SNA) and the Balance of Payments Compilation. Goods

are defined in the SNA as “physical objects for which a demand exists, over which ownership rights can be

established and whose ownership can be transferred from one institutional unit to another by engaging in

transactions on markets”.

“This is a preliminary release, full details would be published in the “MONTHLY EXTERNAL TRADE

STATISTICS” report by the Department of Statistics, Malaysia, to be disseminated on Friday, 2nd July 2021

and can be downloaded through statistic at the Department of Statistics, Malaysia’s portal

(https://www.dosm.gov.my/v1).

+ This media release can be accessed through the portal of Malaysian External Trade Statistics, Ministry of

International Trade and Industry (http://www.miti.gov.my) and Malaysia External Trade Development

Corporation (http://www.matrade.gov.my).

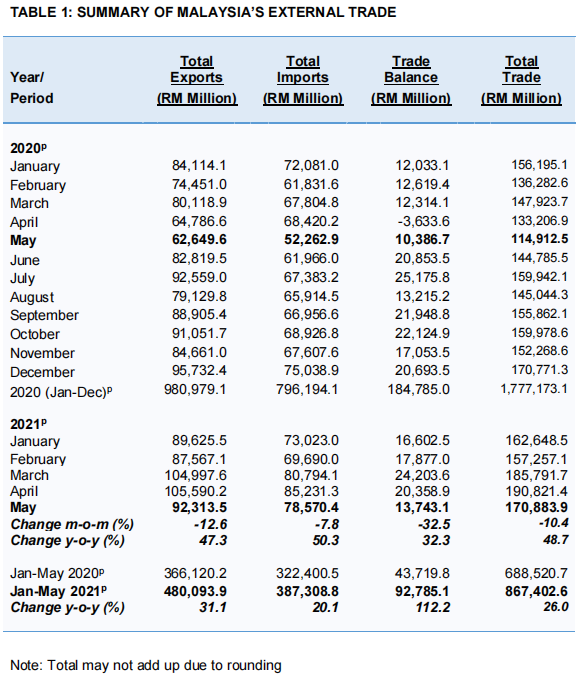

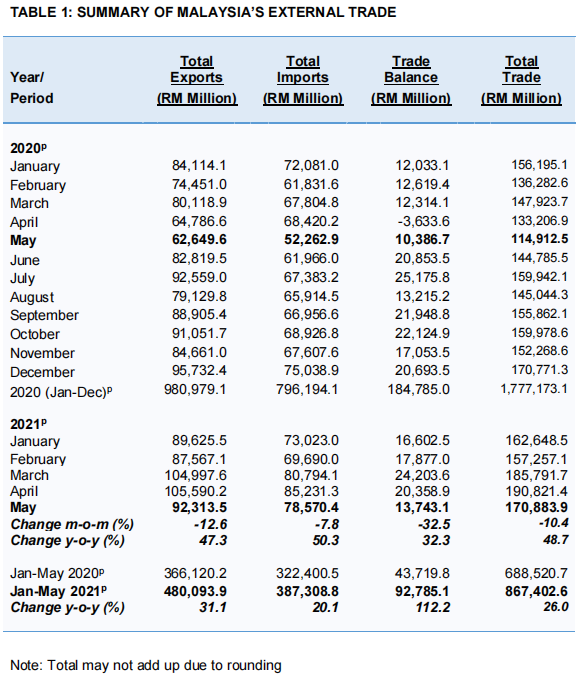

The May 2021 data is provisional and subject to revision in later issue.

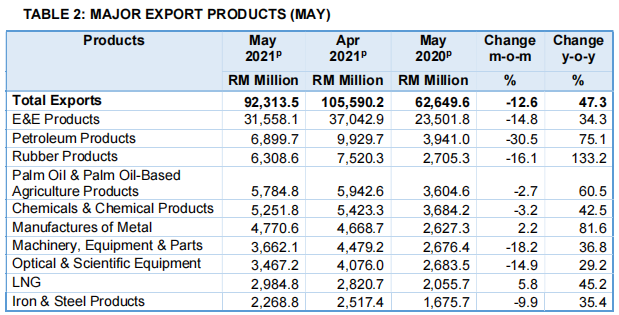

With effect from reference month April 2018, selection of codes for exports and imports of palm oil and palm

oil-based products has been reviewed and revised for better representation of the product and this has

resulted in some changes to the data.

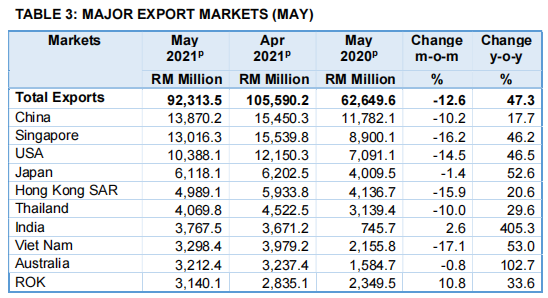

FTA partners comprises of 19 countries: China, Singapore, Japan, Thailand, Republic of Korea, Indonesia,

India, Australia, Viet Nam, Philippines, New Zealand, Turkey, Pakistan, Myanmar, Cambodia, Brunei, Chile,

Lao PDR and Hong Kong SAR.

With effect from reference month of February 2020, the United Kingdom no longer be a Member State of the

European Union (EU).